We pool investors' funds into high value commercial loans using mortgages as security

We pool investors' funds into high value commercial loans using mortgages as security

OTG Asset Backed Loan Fund

Quick facts

8.75% p.a paid monthly*

9.11% p.a reinvested*

*Forecast return fm 1 Jan 26, future yield is not guaranteed

September 2018

Fixed income, illiquid, secured commercial debt

Commercial loans, secured with valuable properties - Popular east coast Australian city markets only

Fund Overview

We pool our investor funds into valued commercial loans that are fully secured using first and second mortgages on popular east coast capital city real estate assets.

Past Performance as at 01/01/2026

Past returns does not indicate future performance.

| Start | 1 month | 3 months | 6 months | 1 year | 3 years | 1/9/18 |

| Income* | 0.729% | 2.188% | 4.375% | 8.750% | 8.667% p.a | 7.547% p.a |

| Reinvested^ | 0.729% | 2.203% | 4.456% | 9.110% | 8.985% p.a | 7.770% p.a |

* The income rate is when coupons are not reinvested at any interest rate.

^ The reinvested rate is when coupons are reinvested at the same interest rate.

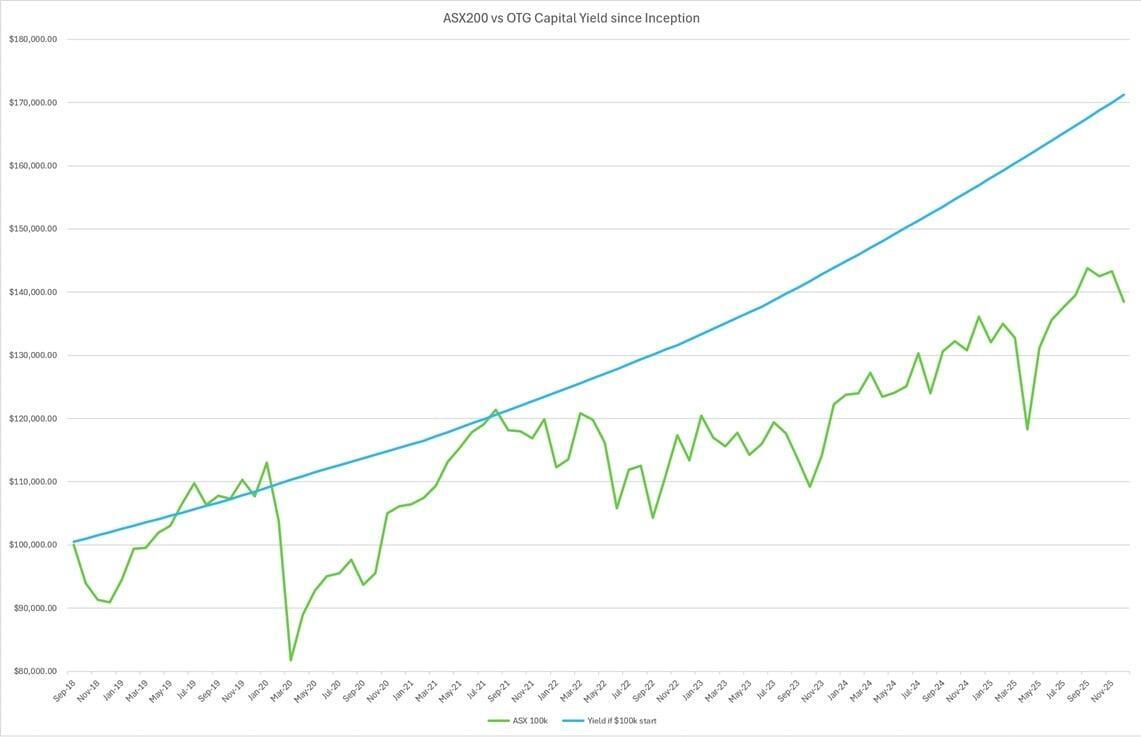

$AU 100,000 with OTG's Fund at Inception vs S&P/ASX 200

While this graph compares the ASX200 and OTG Capital (reinvested), it does not mean the risk weighted returns are created equal. Equities in the ASX200 are highly liquid and a redeemable return can be priced daily whereas an investment with OTG is illiquid. See this link for more details on performance.

Risks

When a borrower does not pay back a loan, security can be sold to regather capital and any interest and costs. However, if the value of security goes down in combination with a borrower default, losses can be incurred. Specifically, risks associated with an investment include default by borrower, overstated valuations, litigation and documentation risks, inadequate insurance and decline in the property market. This is further explained here and in the Information Memorandum.

Diversification

OTG Capital utilises multiple city locations, varying loan sizes, 6-18 month loan maturity dates. Loans are used in residential and commercial settings and range between full service and interest only loans upto 60-70% LVR. These loans are typically used in order to bridge other loans or provide funding for development.

Quick Details

LVR (loan to value ratio)

between 60% - 70%

Minimum investment

$AU 25,000

Investor

Wholesale/Sophisticated

Management style

Active

Distributions (if selected)

Monthly

Liquidity status

illiquid fund - usually 30 - 45 days

Public Trustee

AMAL - over $AU 16Bn FUM

Fees (net after yield)

2% - 4% of FUM

Past Yield changes

Past returns do not guarantee future performance. Future yields are not guaranteed.

| Yield Review/Change | Date | Monthly Return | *Forecast Effective Annual Return (reinvested) |

| 0 | September 2018 | 0.500% | 6.17% p.a |

| 1 | November 2019 | 0.563% | 6.96% p.a |

| 2 | June 2020 | 0.488% | 6.01% p.a |

| 3 | March 2021 | 0.575% | 7.12% p.a |

| 4 | November 2021 | 0.587% | 7.28% p.a |

| 5 | December 2022 | 0.646% | 8.03% p.a |

| 6 | June 2023 | 0.729% | 9.11% p.a |

* The monthly return is converted to a effective annual return (reinvested) for ease of comparison. This does not mean that it will eventuate.

Past returns do not guarantee future performance. Future yields are not guaranteed.

Fees

There are no admin fees, no entry or exit fees, and no administrative change fees. All management, administration, Trustee, marketing and regulatory fees are paid before our yield is struck. These fees can vary between 2-4% p.a of FUM depending on market conditions. See the Information Memorandum for more info.

Liquidity

OTG Capital's fund by the nature of how we invest your money, is illiquid. This means that we are not an "at call" bank deposit facility.

While we don't lock your money in, should you need to redeem your investment with us, we usually provide your funds within 30-45 business days depending on the fund's liquidity and cash reserves available at the time of your redemption request.

We also ask a minimum of 30 days’ notice for redemption of part or all of your funds.

Trustees

AMAL (now part of IQEQ) is a major Australian trustee company with over $30Bn under management.

All aspects of our operation works under the normal Australian Financial Services Licenses (AFSL) and ASICs (Australian Securities and Investment Commission) rules and regulations. The Trusts are wholesale and only open to wholesale investors.

Please refer to our Information Memorandum (IM) and Supplementary Terms and Application Pack for further details.

Other Notes

Distributions / Redemptions

We ensure monthly distributions are made within 7-10 working days after the end of the calendar month. As we are not an "at call" bank deposit facility (illiquid), we aim to provide funds redemption within 30-45 business days.

Rate of Return & Interest Rates

Whilst past performance doesn't reflect future returns, as Fund Managers, we aim to perform in a range consistent with a margin above the RBA cash rate providing performance that gives investors comfort their returns are doing better than the underlying cash rate and potentially beating inflation as well. The prevailing lending interest rates will always have an impact on the Trust's returns.

Trust Unit Price

It is intended the Trust's Unit Price will remain $1.00 at all times, with income (after management fees and expenses) being disbursed to investors.

Trust Cash Reserve and Capital Protection

The Trust's cash reserve has not been required at this time. Capital Protection is reviewed on a monthly basis in line with evaluation of the Loan-to-Value-Ratio of all our commercial loan instruments in the market at the time. The Trust's Constitution and Trustee ensures the Trust's Fund Manager never exceed these parameters to safeguard our investors funds and their returns.

Customer Service

Put us to the test, we have an excellent track record with our investors in responding quickly and efficiently to their questions and requests for further information. Call us on 1300 OTG CAP (684 227) any time to talk to our team.

- ensuring all loans are secured with mortgages over real property assets

- loans are secured with LVRs usually between 60% - 70%

- our loans are generally short term in nature, safeguarding potential risk against interest rate movements, and delivering liquidity to the fund

- If a borrower is unable to pay interest or the loan when due or fail to repay the loan when due.

- OTG Capital ensures all loans are secured by 1st and 2nd ranking mortgages over a valued property located in popular east coast markets. This security can be turned into cash if required.

- This risk may arise where the sale of a property is insufficient to repay the loan in full.

- OTG Capital confirms the appraisal by a reputable valuer before a new loan is made. We adhere to conservative Loan to Value Ratios (LVR’s).

- We face risk when security properties are sold to enforce the mortgage. Proceedings can take time and money which may impact the loan return. This risk is higher in 2nd ranking mortgages.

- OTG Capital’s wholesale lender mitigates this risk by working within a conservative LVR and ensuring it always has industry standard legal documentation held by an external custodian.

- We face risk where the security property secured is damaged or destroyed and no, or inadequate, insurance is held.

- OTG Capital only invests in commercial loans offered by wholesale lenders whose procedures include ensuring all properties are adequately insured at all times during the term of the loan.

- Downward movements in the property market may impact loan security and our ability to fully recover the loan, interest and costs. This in turn may impact the Trust’s returns.

- OTG Capital manages and regularly monitors this risk by strictly complying with its lending and LVR guidelines.

- We also mitigate risk by the short duration of the loans we invest in (usually no longer than 12-18 months).

And if you're still not sure, please call us, we'd be happy to discuss any concerns you have. We also recommend you seek personal advice from a licensed qualified financial planner if you are still not sure.

Wholesale & Sophisticated investors are accepted only, we are not a retail fund. In accordance with the Australian Corporations Act, to be eligible to invest with OTG Capital you are at least one of the following;

- Classified as a sophisticated investor, or;

- You have net assets of $2.5million, or;

- You have a gross income of the last 2 financial years of at least $250,000 per annum.

- Intending on investing $500,000 or more, or;

- Operating a self managed superannuation fund within certain criteria.

- We accept minimum investments of $25,000 and additional amounts in $10,000 increments should you wish to increase your sum later.

- The maximum investment amount we accept is $10 million.

- We have no fixed terms and you can keep your investment with us for as long (or short) as you like.

- Fund redemptions are always subject to the Trust's liquidity (view liquidity tab).

Why would you choose to invest in OTG Capital's fund?

To make better returns than cash term deposit interest rates. If you're satisfied continuing to earn bank interest on fixed deposits that involve meagre returns and long term commitments, then the answer is simple.

We understand everyone's need to hold a certain amount of cash reserves in "at call" accounts for cash flow and liquidity. We also believe that additional cash reserves that don't need at call immediacy should therefore work far harder for you.

OTG Capital's Investment Trust doesn't lock your money in, while still providing solid returns, above term deposit rates. The Fund Managers at OTG Capital have extensive finance industry experience, and OTG Capital's Fund Management have been involved in Asset Backed Investments using mortgages for more than 25 years.

So while OTG Capital as an Investment Trust is over 7 years old now (commenced Sep 2018), this form of investing has provided solid returns even during the GFC years. And while past performance is no guarantee of future returns, using mortgages over real property assets to secure commercial loans is a proven formula that provides a lower risk profile for investors and their funds.

Our offer:

- Diversified short term loan portfolio sourced from a range of lenders

- Secured by real property from Australia's popular east coast city markets

- LVR's usually between 60% - 70%

- No lock-in periods, no hassle

- No entry or exit fees, no set up fees and no admin fees if you wish to switch from income to compounding or vice versa

OTG Capital is not a financial planning organisation, we only provide general advice.

General Advice is an ASIC legal definition that relates to information we provide to You. It means the information is general in nature and does not take into account your personal circumstances or your financial background.

If you are in any doubt, we strongly recommend you seek financial advice from a suitably qualified professional.

OTG Capital is licensed as a Corporate Authorised Representative (CAR#001250963) by OTG Capital Pty Limited under their Australian Financial Services License (AFSL#551695) to provide General Advice only in relation to the OTG Capital Asset Backed Investment Trust.

Learn more:

Start Investing?

Begin in 3 easy steps.

Register - pass KYC and qualify as wholesale investor

Choice - Select income or reinvest

Earn - Let your capital do the work.